How Illegal Gambling Works

The Internal Revenue Service (IRS) can only tax income that it knows about. For a bold segment of the taxpaying public, this is an invitation to hide as much money from the IRS as possible. Hiding money is a form of underreporting income in which there is no question that the perpetrator is committing tax evasion. You don't 'accidentally' deposit millions of dollars in gambling winnings in an untraceable offshore account. This type of tax evasion requires a knowing intent to cheat the system and is punishable by significant jail time.

Gamblers place bets with a bookmaker ('bookie') at a tavern, bar, barber shop, social club, or any other semi-private place that acts as an illegal betting parlor. Runners carry the money and betting slips between the betting parlors and the headquarters, called a numbers bank.

Money laundering is a prime example of evading taxes by hiding the source and amount of income. Money laundering is an attempt to disguise illegal income -- from a drug operation, illegal gambling ring or other form of organized crime -- as legitimate income, or to erase evidence of the income altogether.

Advertisement

- Illegal gambling often takes the form of otherwise legal games put on in illegal venues, which complicates the issue even further. Slot machine must be licensed. One of the most common types of illegal gambling involves games that may otherwise be legal in illegal venues that do not have permission from the state to operate.

- For the most part, gambling is regulated by state law, so whether a particular instance of gambling activity is illegal depends on the law in your state. However, online gambling is illegal throughout the country under federal law. You can report online gambling to the FBI.

- A look inside the illegal gambling market that threatens the integrity of the legal, regulated casino gaming industry.

- Illegal gambling operations have been popping up more frequently in Long Beach over the last year. From a former dollar store in Zaferia to an old thrift shop in North Long Beach, experts say these black-market businesses tend to appear where retail has taken a downturn.

Advertisement

In the past, money laundering was primarily accomplished through a front, or shell company, two terms describing an incorporated legitimate business with no real function other than to 'clean' dirty money from an illegal activity [source: Legal Information Institute]. The classic example is a beauty salon or a dry cleaning business that never seems to be open. The money launderers draw up fake invoices and receipts to create the appearance of a thriving business. But instead of earning real income, the money launderers deposit funds earned from the illegal activity. The downside of traditional money laundering is that criminals still have to pay taxes on this phony income.

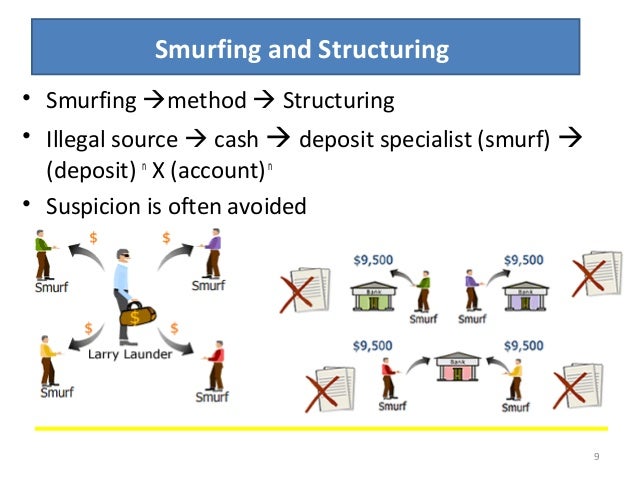

Today, thanks to a largely electronic banking system, modern money launderers have become experts in hiding both the source and destination of money through complex international banking transactions. For example, a money launderer can set up hundreds of separate bank accounts around the world in different names. He can then deposit small amounts of dirty money in each account so as not to draw attention. This is called layering. Withdrawals from these accounts are equally complex and layered, making it hard for investigators to follow the paper trail.

Foreign or 'offshore' bank accounts are a popular place to hide both illegal and legally earned income. By law, any U.S. citizen with money in a foreign bank account must submit a document called a Report of Foreign Bank and Financial Accounts (FBAR) [source: Internal Revenue Service]. But that doesn't stop millions of Americans from secretly funneling money into untraceable offshore accounts.

The IRS initiated a voluntary offshore disclosure program in 2009, promising limited penalties and no criminal prosecution to people who come clean about unreported money in foreign banks. So far, it has collected $4.4 billion in back taxes from 33,000 separate voluntary disclosures [source: Internal Revenue Service]. Also in 2009, the United States signed a treaty with Switzerland to gain unprecedented access to the Swiss bank accounts of Americans suspected of tax evasion [source: Internal Revenue Service].

Now let's take a closer look at business and corporate tax evasion.

Gambling Law: An Overview

Gambling, though widespread in the United States, is subject to legislation at both the state and federal level that bans it from certain areas, limits the means and types of gambling, and otherwise regulates the activity.

Congress has used its power under the Commerce Clause to regulate interstate gambling, international gambling, and relations between the United States and Native American territories. For example, it has passed laws prohibiting the unauthorized transportation of lottery tickets between states, outlawing sports betting with certain exceptions, and regulating the extent to which gambling may exist on Native American land.

Each state determines what kind of gambling it allows within its borders, where the gambling can be located, and who may gamble. Each state has enacted different laws pertaining to these topics. The states also have differing legal gambling ages, with some states requiring the same minimum age for all types of gambling, while for others, it depends on the activity. For example, in New Jersey, an 18-year-old can buy a lottery ticket or bet on a horse race, but cannot enter a casino until age 21. Presumably, the age 21 restriction is due to the sale of alcohol in that location.

A standard strategy for avoiding laws that prohibit, constrain, or aggressively tax gambling is to locate the activity just outside the jurisdiction that enforces them, in a more 'gambling friendly' legal environment. Gambling establishments often exist near state borders and on ships that cruise outside territorial waters. Gambling activity has also exploded in recent years in Native American territory. Internet-based gambling takes this strategy and extends it to a new level of penetration, for it threatens to bring gambling directly into homes and businesses in localities where a physical gambling establishment could not conduct the same activity.

Internet Gambling

Federal Regulation

In the 1990s, when the World Wide Web was growing rapidly in popularity, online gambling appeared to represent an end-run around government control and prohibition. A site operator needed only to establish the business in a friendly offshore jurisdiction such as the Bahamas and begin taking bets. Anyone with access to a web browser could find the site and place wagers by credit card. Confronted with this blatant challenge to American policies, the Department of Justice and Congress explored the applicability of current law and the desirability of new regulation for online gambling.

In exploring whether an offshore Internet gambling business taking bets from Americans violated federal law, attention was focused on the Wire Act, 18 U.S.C. § 1084 (2000). The operator of a wagering business is at risk of being fined and imprisoned under the Wire Act if the operator knowingly uses a 'wire communication facility' to transmit information related to wagering on 'any sporting event or contest.' 18 U.S.C. § 1084(a). An exception exists if that act is legal in both the source and destination locations of the transmission. § 1084(b). The Wire Act’s definition of “wire communication facility” appears to embrace the nation's entire telecommunications infrastructure, and therefore probably applies to online gambling. See § 1081.

The Department of Justice maintains that, under the Wire Act, all Internet gambling by bettors in the United States is illegal. U.S. House of Representatives Committee on the Judiciary Hearing on Establishing Consistent Enforcement Policies in the Context of Online Wagers, 110th Cong., Nov. 14, 2007 (testimony of Catherine Hanaway, U.S. Attorney (E.D. Mo.), Dept. of Justice). The Fifth Circuit disagreed, ruling that the Wire Act applies only to sports betting, not other types of gambling. In re MasterCard Int’l Inc., 313 F.3d 257 (5th Cir. 2002).

In 2006, Congress passed the Unlawful Internet Gambling Enforcement Act, which made it illegal for wagering businesses to knowingly accept payment in connection with unlawful Internet gambling (though it does not itself make Internet gambling illegal). 109 Pub. L. 109-347, Title VIII (Oct. 13, 2006) (codified at 31 U.S.C. §§ 5301, 5361–67). It also authorizes the Federal Reserve System to create regulations that prohibit financial transaction providers (banks, credit card companies, etc.) from accepting those payments. See 31 U.S.C. § 5363(4). This Act, along with threats of prosecution under the Wire Act from the Department of Justice, has caused several Internet gambling businesses to withdraw from the U.S. market.

In response, House Representatives introduced multiple bills in 2007 to soften federal Internet gambling law. If passed, the Internet Gambling Regulation and Enforcement Act and the Internet Gambling Regulation and Tax Enforcement Act would license, regulate, and tax Internet gambling businesses rather than prohibit them from taking bets from the United States. Alternatively, the Skill Game Protection Act would clarify the Wire Act to exempt certain games such as poker and chess.

State Regulation

In addition to federal measures, some states have enacted legislation to prohibit some types of Internet gambling. In 2006, Washington State amended its Code to make knowingly transmitting or receiving gambling information over the Internet a felony. See Wash. Rev. Code § 9.46.240 (2006). Other states with similar prohibitions have made it a misdemeanor instead. See e.g., 720 ILCS 5/28-1 (2007).

Why Is Online Gambling Illegal

States have not been particularly active in enforcing these laws, possibly due to a conflict with the dormant Commerce Clause doctrine. That doctrine theorizes that state law applying to commerce outside the state’s borders is unconstitutional because that power lies with federal, not state, government. In particular, federal preemption has obstructed states’ attempts to regulate gambling activity on Indian reservations within state borders. See Missouri ex rel. Nixon v. Coeur D’Alene Tribe, 164 F.3d 1102 (8th Cir. 1999). The federal Indian Gaming Regulatory Act, 25 U.S.C. § 29 (2000), governs gambling activity on Indian reservations, but the extent to which it and other federal gambling laws preempt state action in the Internet arena is uncertain.

menu of sources

Federal Material

U.S. Constitution and Federal Statutes

- U.S. Code: Title 15, Chapter 24: Transportation of Gambling Devices

- U.S. Code: Title 15, Chapter 57, Interstate Horseracing

- U.S. Code: Title 18, Chapter 50: Gambling

- U.S. Code: Title 18, Chapter 61: Lotteries

- 18 U.S.C. §1953 (Interstate Transportation of Wagering Paraphernalia Act)

- 18 U.S.C. §1955 (Illegal Gambling Business Act of 1970)

- 25 U.S.C. §§2701-2721 (Indian Gaming Regulatory Act)

- U.S. Code: Title 28, Chapter 178: Professional and Amateur Sports Protection

- Code of Federal Regulations: Title 25, Chapter 3: National Indian Gaming Commission, Department of the Interior

- Proposed Internet Gambling Prohibition Act of 1997 (not passed)

Federal Judicial Decisions

- Greater New Orleans Broadcasting Association, Inc. v. United States, 527 U.S. 173 (1999)

- Ratzlaf v. United States, 510 U.S. 135 (1994)

- Chickasaw Nation v. United States, 534 U.S. 84 (1999)

State Material

How Illegal Gambling Works Online

Other References

Illegal Gambling Cases

- '14 Charged in Internet Betting' (Washington Post, March 5, 1998)

Illegal Gambling Statistics

- wex